As a parent, you probably want to teach your kids things like respect, to do chores, how to read, and many other things. However, many parents don’t give as much attention or importance to a certain aspect as they should: financial education.

Kids need to learn the value of money from an early age and manage it like an adult. By being financially smart, your children will learn to be responsible adults and make healthy decisions in the future.

Sure, you could give them cash, but giving them a debit card over cash has some advantages. They are convenient and will teach your children how to be disciplined with money and saving to purchase something they want to buy.

Is Greenlight debit card legit?

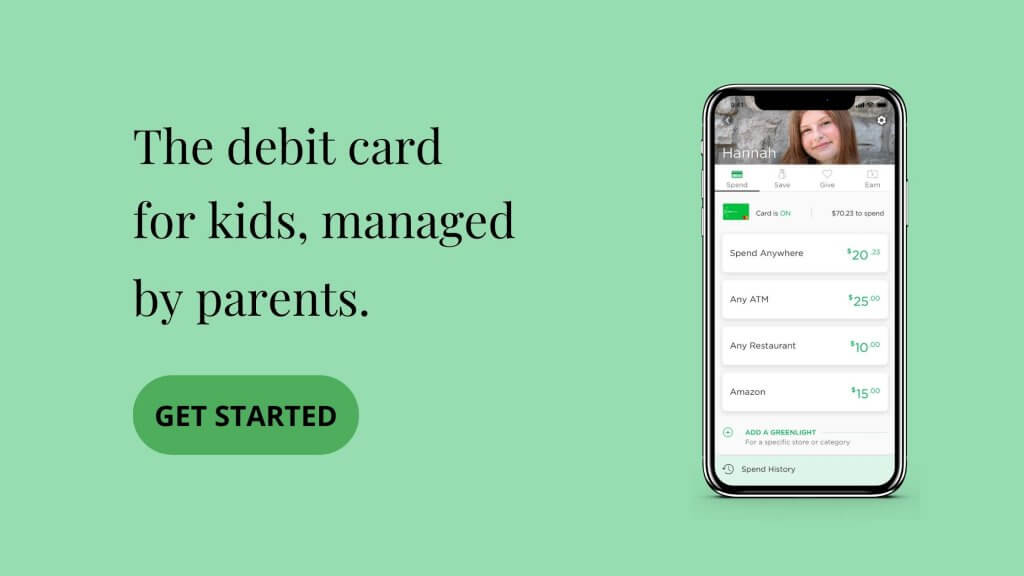

Yes, it is legit. Greenlight is like any other debit card in which it takes money from the account after using it to make a purchase. What differs it from others is that you will have more control over it as a parent.

What Are The Features?

One of the best features of the Greenlight debit card is that you can set an interest rate, and interest will be paid into their account which comes out of the parent’s account. This will teach them how to save money through compound interest.

You will also have control over your child’s expenses by separating them into two categories: one with parental control where you can block purchases from certain stores, and one in which your kids can spend wherever they want.

Parents can also transfer money really quickly to their child’s account wherever they are. The child can send a request for the money. This type of transaction is instant and free of charge.

How Can You Transfer Funds To Greenlight?

You can deposit funds into your account via direct deposit, Apple Pay, debit cards, or ACH. Greenlight has a minimum deposit of $20 for the initial transaction, $1 for the following transactions, and $1 for direct deposits, and with a debit card, the minimum transfer is $20.

Is the Greenlight card safe?

Yes, it is safe. The cards also have chips that makes it hard for any of your card or account information to be duplicated. You can also enable notifications to track your purchases and see if there are any suspicious purchases. In case your child loses their card, you can disable it on the app instantly by tapping on the child that lost the card, and the next step is to click “card is on”. Then it will show a confirmation asking if you really want to disable that card. Next, call (888) 483-2645 to request a new card that will arrive at your address.

How much does Greenlight cost?

With Greenlight, you won’t have to worry about hidden fees. They offer a 30-day trial, then Greenlight charges a monthly fee of $4.99, zero pin transaction fee, and zero signature transaction fees. Parents also have the option of personalizing their cards with a photo of their child for a one-time fee of $9.99. You can add up to 5 kids without additional costs. In case your child loses their card, the first replacement card is free. Additional cards will cost $3.50 each. Greenlight is also FDIC insured on up to $250,000.